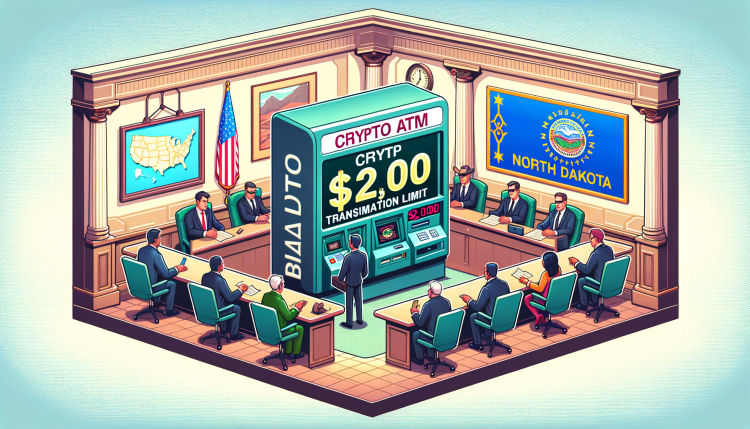

North Dakota Tightens Regulations on Crypto ATMs

In response to the growing presence of cryptocurrencies, North Dakota is moving forward with legislation to regulate crypto ATMs. The state’s Senate took steps to tighten controls that were initially relaxed by the House, setting a $2,000 limit on daily transactions per user. This decision reflects the state’s priority to maintain a cautious approach towards cryptocurrency transactions, considering the potential risks associated with digital currencies.

Key Highlights of the Bill

- New Regulation: North Dakota’s Senate has amended a bill concerning crypto ATMs, limiting daily transactions to $2,000 per user, which the House initially loosened.

- Consumer Protection: The bill aims to protect residents from potential scams associated with cryptocurrency transactions by introducing stricter guidelines and requirements for ATM operators.

- Regulatory Details: Operators must be licensed, and users will receive fraud warning notices before transactions, ensuring more secure and transparent operations.

The Senate’s amendments are designed to protect consumers from fraudulent activities by enforcing stricter oversight on crypto ATM operators. This includes a licensing requirement as money transmitters, which is intended to ensure operators meet a baseline of security and reliability standards. With these regulations, North Dakota seeks to offer a safer environment for its citizens engaging in crypto transactions, mitigating the risks of scams and fraud that can be prevalent in this digital financial space.

Moreover, to further protect users, the bill includes provisions for mandatory fraud warnings at every transaction point. Users attempting to conduct cryptocurrency transactions through these ATMs will be alerted to potential risks, promoting informed decision-making. The Senate’s overwhelming majority vote in favor of these changes signifies strong legislative support for protecting consumers while still allowing access to cryptocurrency services.

Hot Take

In an era where digital currency continues to evolve, it’s crucial to balance accessibility and security. North Dakota’s legislation is a prudent step towards ensuring individuals can benefit from modern financial technologies without undue risk.

By demanding transparency and accountability from crypto ATM operators, the state not only promotes informed consumer use but also signals its readiness to embrace the future of finance with a firm hand on regulatory norms. This could set a precedent for other states considering how to integrate cryptocurrency infrastructure responsibly.