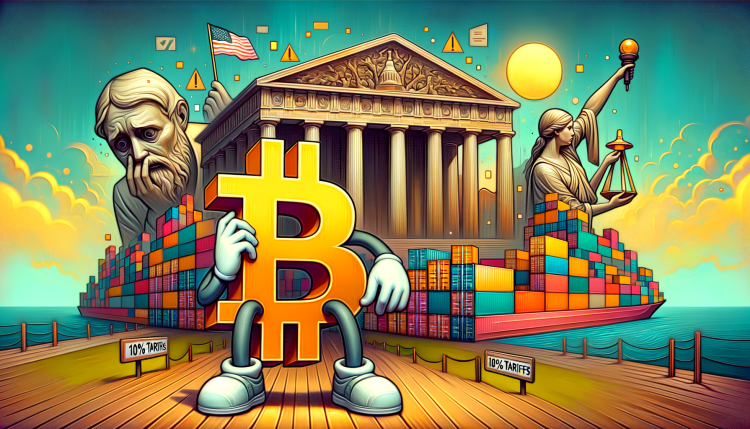

Impact of New Tariffs on Bitcoin and Global Markets

Key Points:

- Tariff Announcement Impact: The White House confirmed that a 104% tariff on Chinese goods will soon start, impacting global markets, including Bitcoin.

- Bitcoin Price Fluctuations: Bitcoin’s price briefly soared past $81,000 due to false reports suggesting a pause in US tariffs. However, it quickly dropped under $75,000 after the tariff confirmation.

- Market Trends: The S&P 500 and Bitcoin both experienced decreases following the tariff news, but traders are monitoring a “fair gap zone” for Bitcoin as a potential recovery area.

Recently, the U.S. government confirmed it will impose a hefty 104% tariff on imports from China. This policy decision was confirmed by the White House and will begin impacting markets immediately. Such tariffs usually lead to strained trade relations and can potentially increase prices for goods imported from China, affecting businesses and consumers. This announcement has caused significant ripples across various financial markets.

Following false news reports that suggested a pause or delay on these tariffs, Bitcoin saw an unexpected price increase to over $81,000. However, once the official confirmation was made, this surge reversed. Bitcoin, often influenced by broader economic policies and global uncertainty, dropped below $75,000. This represents significant volatility for the cryptocurrency, which traders often anticipate given its history of dramatic swings in response to global news events.

As the news settled in, Bitcoin, along with the S&P 500, saw a decrease in value. Nevertheless, some traders remain optimistic, believing Bitcoin is still trading in what they refer to as a “fair gap zone,” a range where they hope the asset will stabilize or even rally due to renewed buying interest at lower price levels. Market participants will be closely watching economic indicators and government policies to gauge Bitcoin’s next move.

Hot Take: The new tariffs could escalate economic tensions between the US and China, affecting global markets and cryptocurrencies alike. Bitcoin’s volatility is a reminder of its sensitivity to geopolitical news. While this may be unnerving for some investors, others see opportunity in the “fair gap zone” for profitable trades amidst fluctuating conditions. It’s crucial for investors to stay informed and cautious in these unpredictable times.